From grey to green urea

-

- from Shaastra :: vol 03 issue 08 :: Sep 2024

A pathway to decarbonisation, green growth, and jobs.

Limiting global temperature rise to 1.5°C requires the decarbonisation of all economic sectors. While the technology transition is underway in the power and mobility sectors, it is lagging in the steel, cement, and fertiliser industries owing to affordability and accessibility of decarbonisation technologies. But instead of relying on patented novel technologies, a key strategy for these sectors should be to repurpose the existing non-patented technologies and reduce costs through market expansion and innovation. The urea sector offers a model.

Urea production is heavily reliant on natural gas (NG), making it a significant contributor to greenhouse gas (GHG) emissions. In India, the average emissions intensity of urea production is 0.7 MT CO2e/MT; urea use in agriculture results in an additional 4.0 MT CO2e/MT. Together, urea accounts for 4.3% of India's total GHG emissions and 22% of its agricultural emissions. Urea use also emits nitrous oxide (N2O), a potent GHG and ozone-depleting substance. Decarbonising the urea industry and optimising its application would mitigate both global warming and ozone layer depletion, addressing two critical environmental challenges.

THE GREEN UREA PATHWAY

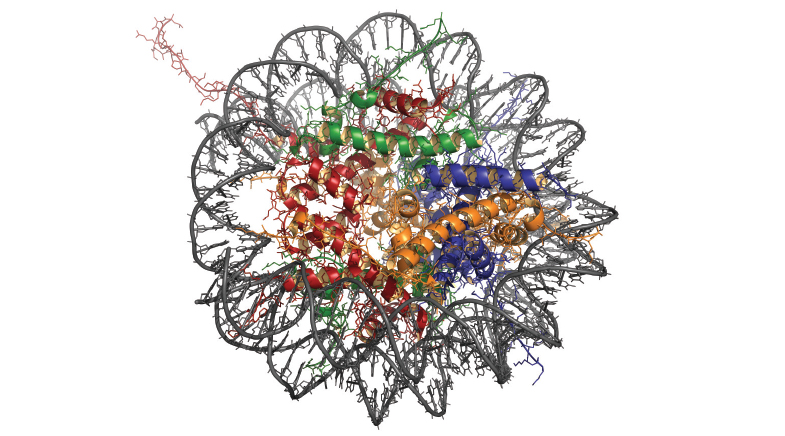

Urea (NH2CONH2) production involves two key processes: the production of ammonia (NH3) and the subsequent reaction of ammonia with carbon dioxide (CO2). Ammonia synthesis, by the Haber–Bosch process, requires pure hydrogen (H2) and nitrogen (N2). Indian urea plants use steam reforming of NG to produce H2 and CO2, with N2 sourced from air separation.

However, green hydrogen (GH2) production using alkaline electro-lyser is an age-old technology. In the 1970s, the Fertilizer Corporation of India's Nangal plant employed electrolysis to produce hydrogen; it later switched to hydrocarbons due to shortage of power in the Bhakra grid. Likewise, carbon capture and utilisation (CCU) using absorption technologies is widely used in the urea sector. So, the existing technologies themselves offer the possibility of producing 'Green Urea', which could transform urea production into a carbon-negative process. The challenge, though, lies in the cost of these technologies.

Decarbonising the urea industry and optimising its application would mitigate both global warming and ozone layer depletion.

To assess the economic feasibility of decarbonising India's urea industry, my colleagues and I conducted a techno-economic modelling study of all 36 urea plants in India, exploring potential pathways for decarbonisation by 2050.

Our analysis considered three urea production pathways — Grey, Blue, and Green Urea — each with different GHG intensity. Additionally, we examined two types of plant modifications: upgrading existing facilities (brownfield) or constructing new plants (greenfield). We also accounted for cost uncertainties through three scenarios:

- Median. Assumes 'middle way' costs for critical technologies and commodities.

- Optimistic. Favours decarbonisation with higher NG prices and lower costs for green technologies.

- Pessimistic. Presents unfavourable conditions for decarbonisation: lower NG prices, higher costs of green technologies.

For each scenario, we estimated the Levelised Cost of Urea (LCOU) to determine the most cost-effective decarbonisation strategy for each plant.

RESULTS AND INSIGHTS

Our modelling results indicate a transition towards Green Urea as the most cost-effective option post-2028. The estimated LCOU for Grey, Blue, and Green Urea from a model greenfield plant between 2025 and 2050 suggests that while Grey Urea remains the cheapest option until 2028, Green Urea becomes more economical thereafter. By 2030, the LCOU for Green Urea is projected to be 20% lower than that of Grey Urea, and by 2050, this cost advantage increases to nearly 100%. In contrast, Blue Urea, which uses carbon capture technologies without fully transitioning to green processes, is unlikely to be economically viable during most years.

Plant-specific modelling also shows that Green Urea is the most economically viable option for the Indian urea sector; all existing urea plants can be transitioned to brownfield/greenfield Green Urea by 2050. The LCOU for the Green Urea scenario for the entire sector, in which all plants move to brownfield/greenfield Green Urea by 2050, is $475/MT urea compared to $540/MT urea in the Grey Urea scenario, in which existing plants remain on natural gas with brownfield/greenfield modifications till 2050 and beyond (more details: bit.ly/green-urea).

POLICY IMPLICATIONS

To capitalise on this opportunity, there is a case for establishing a 'Green Urea Mission', which would lower urea production costs, reduce subsidies, and foster the development of two critical industries: green hydrogen and CCU. The National Green Hydrogen Mission, which aims to make India a global leader in green hydrogen production, will get a large domestic market in the urea sector. As Green Urea transition will sequester an estimated 350 million MT CO2e during 2025-50, it will simultaneously help establish a robust CCU industry.

This could serve as a model for other hard-to-abate sectors, highlighting the potential of existing decarbonisation technologies to achieve green growth and jobs.

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH