The bold new biotechpreneurs

-

- from Shaastra :: vol 01 edition 01 :: May - Jun 2021

A handful of Indian start-ups is venturing into the high-risk, high-attrition pursuit of new drugs, enabled by an emerging ecosystem.

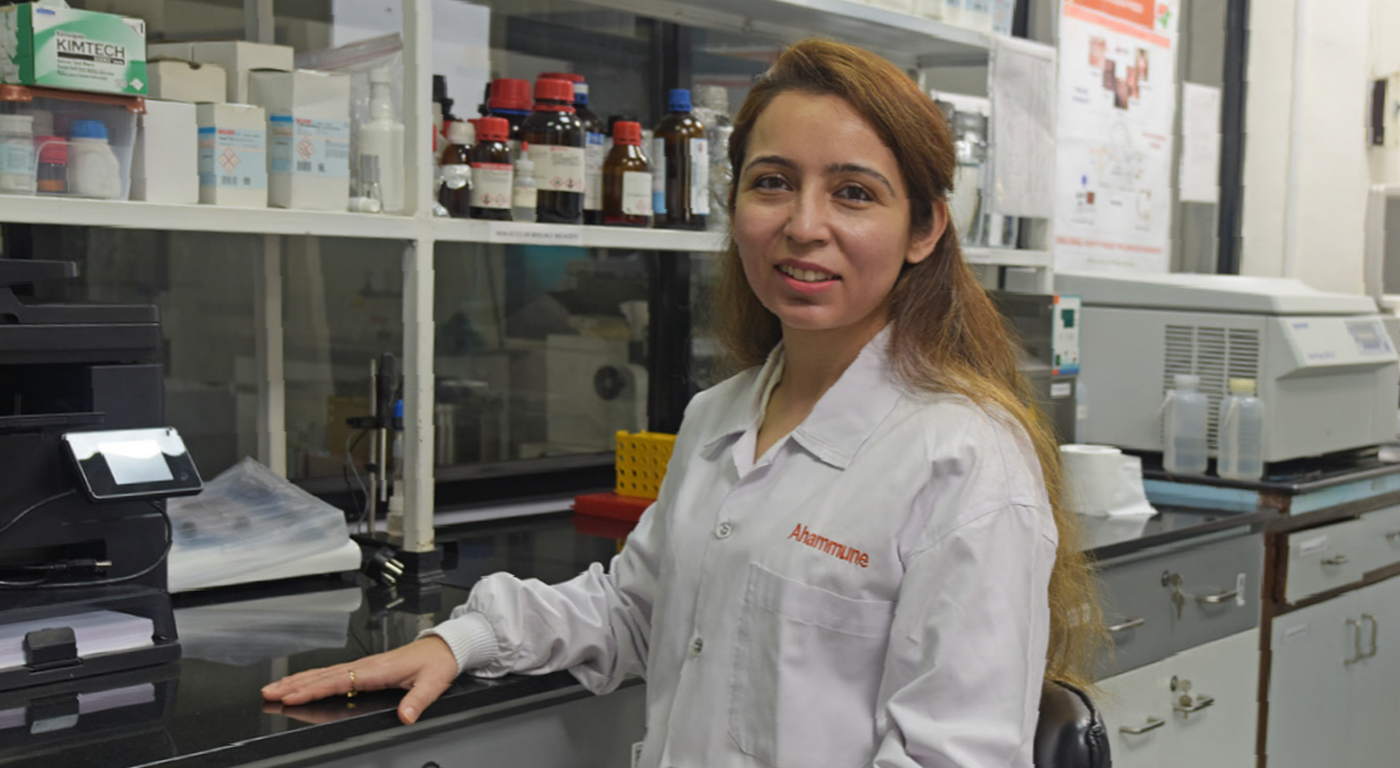

WHILE pursuing her doctorate in skin biology at the National Institute of Immunology, in New Delhi, Parul Ganju’s research led her to people living with vitiligo. This is a disease that causes visibly discoloured patches on the skin and hair resulting from the loss of melanocytes, the skin’s pigment cells. It has no known cure. As she heard their stories of social stigma, Ganju’s academic interest turned into a deeper need to make a positive impact. “The effect of this disease was humongous, and they were waiting for something to work.”

Ganju could have gone on to build a career in academia; after her PhD, she won a prestigious government scholarship meant to encourage young scientists in basic research. Yet, she was convinced that for research to turn into solutions, a corporate structure was needed. In 2016, therefore, Ganju partnered with Krishnamurthy Natarajan, collaborator on her PhD project and a professor in the School of Life Sciences at Jawaharlal Nehru University, to start Pune-based Ahammune Biosciences to discover dermatological drugs.

In August 2020, Ahammune applied to the Indian drugs regulator for approval to start first-in-human clinical trials on a topical drug for early stages of vitiligo. In pre-clinical tests, the drug was shown to arrest disease spread by targeting the starting point of a cascade of immune events that kills off melanocytes. It was like “cutting fuel to the fire,” says Ganju.

THE NEW ADVENTURERS

Ahammune is the latest green shoot in the new drug discovery landscape of India. There are a clutch of others. Some began earlier, others are nascent. Their interests span a range of therapy areas: drug-resistant infection, cancer, rare disease, and metabolic disorders such as diabetes. The people behind them could be freshly minted post-docs or seasoned drug industry professionals. Yet, their goal is the same: to discover a new drug and take it to the global market.

If this sounds familiar, well, it is. Through the 1990s and the early 2000s, publicly listed Indian off-patent or generic drug companies embarked on this journey. With hoary multinational drug companies such as Merck and Pfizer as their model, they built lavish laboratories, paid top dollar for talent and seemed set for the long haul. After all, it takes an average 10 years for a drug to go from lab to market.

But the stock market ran out of patience. Eventually, barring some exceptions, they scaled back or shuttered their discovery operations to focus on the core business of generics.

The new players on the drug discovery landscape have interests that span a range of therapy areas. But their goal is similar: to discover a new drug and take it to the global market.

Drug discovery is an expensive, highrisk pursuit. According to a 2020 study published in the Journal of the American Medical Association (JAMA) Network, of 63 new drugs approved in the US between 2009 and 2018, the median capitalised cost of R&D was $985 million per drug. This accounts for failures as well. A 2019 analysis in Nature Reviews Drug Discovery found that the chance of success for a compound entering Phase 1 trials has remained slightly under 10 per cent over the past two decades.

Yet, this relatively new breed of drug companies is inspiring hope, combining an appetite for risk with quality science.

Take Noida-based Curadev. It has won early validation for its efforts in immuno- oncology out-licensing its molecules to Bayer, Takeda and Roche. Or consider Bengaluru-based Bugworks Research, which is on the cusp of putting the first of a completely new class of broad-spectrum antibiotics into human trials, to combat the dual global threats of drug-resistant infection and bioterrorism.

Also in Bengaluru, Zumutor Biologics is lining up a pipeline of novel monoclonal antibodies (mAbs) against cancer, with a potential first-in-class mAb for prostate cancer inching close to human trials.

And in Chennai, Sekkei Bio is designing novel insulin, which can withstand the harsh environment of the gut, for oral delivery, and dual agonist peptides. Sekkei combined forces with another start-up, Quest Compbio, which had computational biology expertise and an interest in neuropathic pain relief.

“Small companies are definitely pushing hard,” says T.S. Balganesh, a veteran scientist who has led innovative R&D efforts in both government and industry. “There are credible people behind them who are driven by passion and science.”

In their stories lie clues to India’s evolving drug discovery landscape.

“It is ideas – and not concrete, iron and steel – that should make us,” says Anand Khedkar, co-founder, Sekkei Bio. Khedkar spent two decades leading an ambitious project to develop insulin tregopil for oral administration in the well-equipped – and well-funded – R&D lab of Bengaluru-based Biocon before he quit to start Sekkei with co-founder Monalisa Chatterji, also a former senior scientist at Biocon. At Sekkei, they run a lean ship, with a team of less than 10, and hire consultants and vendors for a range of R&D services.

FRUGAL INNOVATION

Companies such as Sekkei differ in important ways from the pioneers. Their founders have wagered a considerable bit of their savings, sold off ancestral property and knocked on many doors for funding. Ergo, upfront capital and human resource investment have to be kept to a minimum: no lavishly built labs or large teams here. This is actually feasible for two reasons.

Firstly, over the past decade, government labs and educational institutions such as the Indian Institutes of Technology (IITs) have set up innovation incubators. Incubatees can rent access to well-maintained, even cutting-edge, lab equipment costing crores of rupees. Additionally, they are assisted to meet various business-related compliances. “We want to dedicate all our energies and resources to the science,” says Ganju, whose company is based at the National Chemical Laboratory’s Venture Center. “Being in the incubator has allowed us to do that.”

In Bengaluru, the Centre for Cellular and Molecular Platforms (C-CAMP), a science-based innovation hub, located in India’s biggest bio campus, uses rigorous selection filters for incubation and funding. This helps “start-ups make their story stronger,” says Taslimarif Saiyed, CEO and Director. “We also constantly ask innovators to show us how they are building global innovation.”

When co-located with other scientific institutes of excellence, incubators facilitate a free flow of ideas within the community and are avenues of learning and collaboration.

AN ENABLING ECOSYSTEM

Secondly, almost in parallel, a robust contract research industry, delivering drug discovery and development-related services to pharma and biotech companies, has emerged in the private sector. From animal testing to chemical synthesis and formulation development, the Indian contract research organisation (CRO) industry offers a suite of services for a fee. Set up primarily to do business with Western companies that offshore to save costs, they have now become an important piece of the Indian discovery ecosystem.

The CRO industry is one reason why companies such as Curadev can hit the ground running, says Arjun Surya, co-founder. “When you find a promising molecule, you have to put everything behind it,” he says. “This may include expertise you don’t have.” Before Curadev, Surya set up and helmed the biology unit at TCG Lifesciences, a CRO. At Curadev, he used his former employer’s chemistry services, among other things.

This makes it possible to have a ‘virtual’ model that prioritises owning the technology and the intellectual property while outsourcing much else, says Chaitanya Saxena, CEO, Shantani Proteome Analytics, an early Venture Center incubatee.

This model also has its downside, but more on that later.

Funding is another critical component, and the Indian government, too, does its bit. Through the Biotechnology Industry Research Assistance Council (BIRAC), an initiative of the Department of Biotechnology (DBT), it has committed ₹250 crore to the largest early-stage biotech funding programme in India in the form of the Biotech Ignition Grant (BIG). BIG awards upto ₹50 lakh to projects with commercialisation potential to reach proof-of-concept in 18 months. Nearly every start-up interviewed for this piece is a BIG grantee.

Put all this together, and you see the makings of an ecosystem that was largely absent when Indian pharma companies first made efforts to discover new drugs. “In the last few years, the ecosystem has definitely catapulted to where it is now,” says Kavitha Iyer Rodrigues, founder and CEO, Zumutor, who counts Biocon and Millipore among her former employers.

This is giving smaller companies a fighting chance. Yet, considerable challenges remain.

THE DOWNSIDE RISKS

The virtual model, as we have seen, has many benefits, but it is not always efficient. Firstly, expertise, for the most part, is scattered across CROs.

A CRO that is good at active pharmaceutical ingredient (API) synthesis may be new to analytical method validation or formulation development and animal work. Each step calls for transfer of knowledge. “Information gets lost in translation,” says Ahammune’s Ganju.

For some services, companies have to look outside India. Shantani’s Saxena did this to screen diabetes compounds on pancreatic islet cells isolated from cadavers. Sekkei’s Anirudh Ranganathan, who founded Quest Compbio, relied on academic contacts in Austria and Canada for in vitro assays for its neuropeptides programme.

STRADDLING CONTINENTS

START-UPS are increasingly moving to a hybrid model, which involves a limited presence in some form in Western countries known for a mature and well-developed drug discovery ecosystem. Zumutor Biologics, which is researching novel antibodies for cancer, was incorporated in Bengaluru in 2013, but two years on was ‘flipped’ into becoming a US holding company. “We wanted to protect our IP and raise venture funding from investors who understand the ‘novels’ play,” says Kavitha Iyer Rodrigues, founder and CEO. Five years ago, Bengaluru-based Aten Porus Lifesciences chose to assign IP around a promising portfolio of molecules with potential in a rare disease to its US spinoff Oraxion Therapeutics. In 2018, Oraxion entered into a $125-million option-to-licence agreement with a US biopharma for these assets. Since then, Aten has also spun-off Avammune Therapeutics in the US for its oncology research. The US spinoffs give investors a therapy focus and the prospect of a smooth exit, says Aten co-founder Aditya Kulkarni, admitting that this was not the initial plan. “The model evolved with time based on where the opportunity lies and the best way to capitalise.”

The early mover was Rhizen Pharma, which was incorporated in Switzerland in 2009, and later opened a US arm to coordinate clinical development. “Drug discovery has to be front-ended in the US/ Europe as they are the best for biotech-related work and raising capital,” says co-founder Swaroop Vakkalanka. This was made easier as Rhizen’s co-owner, drug company Alembic, already had a holding firm in Switzerland. For all these firms, the R&D still happens here. For instance, Zumutor has 36 scientists occupying 16,000 square feet of lab space in Bengaluru and a small co-working space in Boston where it has hired a few consultants. Rhizen’s Hyderabad affiliate Incozen Therapeutics is where a team of roughly 45 is engaged in pre-clinical R&D and chemistry pharmacology, while in the US, Rhizen is focussed on clinical studies, corporate development and partnering activity.

And for some services, such as Chemistry, Manufacturing, and Controls (CMC) or scale-up, start-ups have to be cautious about revealing business-critical knowhow, says Khedkar. “There is a concern that someone else might understand your idea and move much faster than you.” Secondly, Indian CRO services are fee-based, with no option of risk-sharing. Ganju found that the rates were fixed keeping Western clients in mind.

The more dire worry, however, is the ever- present spectre of eventually running out of funds. Beyond BIRAC, there are “gaps in the funding ecosystem in India,” observes Premnath Venugopalan, director, Venture Center. Discovery companies anywhere in the world look to take the molecule up to a point where it can be licensed for upfront and milestone payments to a large pharma company with the experience and big bucks to take it from clinical development through to approval.

The further the asset is in the R&D chain, the higher its chances of snagging a valuable licensing deal. The ideal point to court licensing would be Phase 2B or proof-of-concept (PoC) in humans, where the value is several-fold higher than when it completes pre-clinical studies showing in vitro and in vivo PoC. But rustling up resources even to file an Investigational New Drug (IND) application, that is, seek regulatory approval for Phase 1 or first-inhuman trials, is an uphill task.

Larger government schemes such as the Biotechnology Industry Partnership Programme (BIPP), which can fund these, require the company to match the contribution, notes Arun Papaiah, co-founder Aten Porus Lifesciences, which is pursuing research in immuno-oncology. “It becomes extremely challenging to make up this gap.”

It doesn’t take long to run through a BIG grant in drug discovery, say companies. Curadev has had to licence out molecules earlier than it would have liked in order to plough a good chunk of the payout back into R&D, says Surya. “We are a bootstrapped company,” he points out. “The government is well-meaning, but the cash is just not enough.” His point: innovation needs other sources of support.

THE NEED TO DIVERSIFY

In the meantime, back-up molecules need to be readied, which too needs funds. Shantani learnt this the hard way: it put everything behind its one asset, a diabetes molecule. When it could not get licensed, the company nearly went belly-up. It had to pivot to becoming a discovery services company to earn. “For start-ups that rely on a single asset, if it doesn’t work out, you’re out,” says Saxena.

True, costs may be relatively lower to start with. As Sekkei’s Anirudh observes, the initial cash burn for the oral insulin programme was 20-30 per cent of what it might have been say, in Sweden, where he completed his PhD. But when it gets closer to IND filing, costs begin to get standardised, he says. “Private investors need to step in,” says Balganesh. But there is little interest – or risk appetite – coming from venture capitalists, private equity firms and even high-networth family offices in India.

“Private investment in India prefers information technology, where returns are faster,” says Sriram Shrinivasan, Partner and Health Sciences Leader, EY India. “Discovery offers higher returns, but the wait is longer and there is more uncertainty.”

Even within healthcare innovation, funding flows towards start-ups at the interface of information technology and healthcare such as online pharmacies, says Premnath. C-CAMP’s Saiyed adds that “significant” Series-A funding capacity needs to be created for “non-tech” health solutions just to allow companies to get to IND-enabling studies and/or Phase 1 for their asset. For the most part, very few VCs in India have the risk appetite for drug discovery or are equipped to perform due diligence on such start-ups, says Aten’s Papaiah. “They want a lead investor with healthcare experience, but there may be just one or two such investors in the entire country.”

Private investment that understands the risk and timelines of drug discovery is available – but in the US and Europe, where funds worth several million dollars are raised specifically for early-stage discovery ventures. Can they tap into that?

BIG BUCKS BEYOND BORDERS

“Without the support of global investors and government grant agencies, we would have closed shop,” says Anand Anandkumar, CEO and co-founder, Bugworks Research, a company with promising molecules for anti-microbial resistance (AMR) and biothreats and a case study in successful global networking for science and finance. In addition to seed funding from BIRAC/DBT and Indian angel funding, Bugworks has also got substantial grants from international agencies such as the Wellcome Trust and CARB-X, and investments from India’s 3one4 Capital, Baxter Ventures, USA, Japan’s UTEC and Global Brain, and South Africa’s Acquipharma Holdings. “We have connected brick by brick into a vast global ecosystem in the AMR research space, allowing us to use this network to accelerate our assets.”

Zumutor has been flipped into a US company and Aten has US spinouts for funding and licensing (see box: ‘Straddling continents’). Sekkei has recently raised equity funding from Indian investors, but sees itself looking abroad in a few years.

But everyone agrees that if drug discovery has to thrive in India, it needs more local avenues of financing. Interestingly, most of the suggestions offered require generics companies to take more interest in Indian R&D. Balganesh says that generics companies could partner with start-ups to take a promising molecule to PoC stage in humans before licensing it out to Big Pharma. He observes that many of the leading ones already have offices in innovation hotspots such as Boston, scouting for R&D assets there. “You need them to do that in the Indian scenario.”

EY’s Shrinivasan suggests the creation of venture funds by generics companies, much like Big Pharma has done. “They have the capability to evaluate the research and promoters with a strong feel for numbers.” Anandkumar says that the Indian government could create “deep-funding pools” using the public-private partnership model with contributions from top Indian pharma companies and Indian billionaires. These companies would have the right to participate in auctions of the best assets created. “We need to shake it up,” he says. “DBT seed funding and incubation was version 1.0, but in version 2.0 we need deeper pockets.”

There is an instance of a generic company partnering scientists to float a discovery company. Switzerland-based Rhizen Pharmaceuticals is a partnership, forged in 2009, between Alembic Pharmaceuticals and Swaroop Vakkalanka, a senior scientist and former R&D Head of Glenmark Pharmaceuticals. Rhizen struck some early licensing deals, and its first cancer drug, umbralisib, out-licensed to US-based TG Therapeutics, received accelerated marketing approval in the US on February 5, reportedly the first drug discovered by Indian scientists to do so.

The emergence of innovation incubators in government-funded labs and educational institutions has catalysed this trend: incubatees can rent access to cuttingedge lab equipment, and get assistance to meet business-related compliances.

More recently, the founders of Aten, too, have attracted investments from a few small-to-mid-sized pharma companies in the oncology programme. However, Papaiah sees these as exceptions. Iyer Rodrigues of Zumutor says generics companies would like to see “clear risk mitigation” at Phase 1 before they can consider investing. If that hurdle were cleared, she says, then so would global biopharma companies. “It is the early-stage funding that’s missing.”

THE MISSING LINKS

The inadequate financing, at least partly, could be the result of not having a critical mass of ideas for investors – Indian or global – to choose from. Most of the academia, with some exceptions, has yet to see the potential of marrying science with commerce in India. Academia is a major source of innovation and start-up activity globally, but not in India.

“You need the triumvirate of venture capital, academia and start-ups to not just be in close proximity but feed off each other,” says EY’s Shrinivasan.

There is much, therefore, that still needs to fall into place. Saiyed of C-CAMP believes that “the success of one or two will create an inflection point where riskier projects will start being supported.” Papaiah points out that with Curadev’s licensing deals and Zumutor’s and Bugworks’ molecules closer to Phase 1, the path is being paved.

In spite of the pitfalls, the journey is exciting, the learning curve steep, the mood upbeat. Taking its first drug to IND was a “huge learning experience” for the team, says Ahammune’s Ganju. “The next molecule may take less time.”

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH