The E.V. revolution is revving up

-

- from Shaastra :: vol 01 edition 03 :: Sep - Oct 2021

There's a boom in production and sales of electric vehicles, but batteries hold the key to future growth.

Globally, there's a boom in electric vehicle (E.V.) production and sales, thanks to technological progress, green energy policies and an increase in the number of consumers preferring eco-friendly mobility even at a premium. The key to future growth lies in deep research, specifically in battery technology and in wider deployment of E.V. infrastructure, including charging points and recycling of batteries. Done right, it could pay rich dividends for mobility in a greener planet.

howindialives.com

howindialives.com is a database and search engine for public data

The Context

Global sales of electric vehicles are tipped to grow 5-fold in 5 years

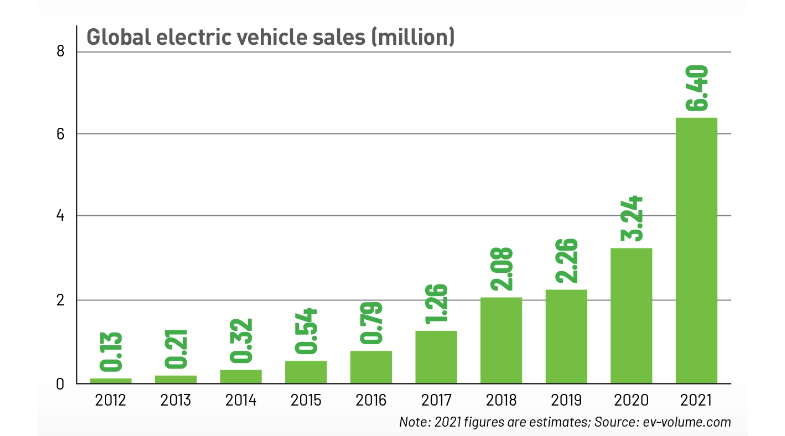

E.V. sales have boomed in the past 10 years globally, from 125,000 units in 2012 to 3.24 million in 2020. Sales are expected to almost double in 2021. While China leads the E.V. market, Europe and the U.S. have seen significant growth. India's E.V. prospects look bright across categories, especially in two-wheelers. When ride-sharing company Ola announced in July it was launching an electric two-wheeler, it received 100,000 bookings in 24 hours. Government data shows that about 120,000 electric vehicles were registered in 2020.

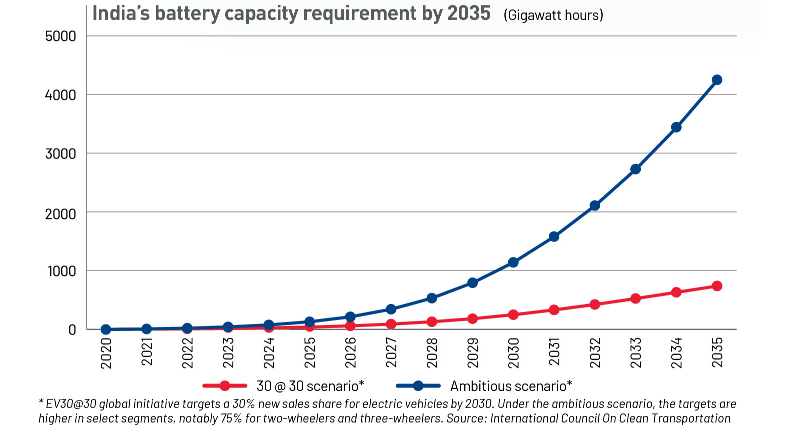

India could need 3,400 GWh of batteries for electric vehicles by 2035

With the growth in E.Vs, the demand for batteries is set to grow. Analysts from the International Council on Clean Transportation, in a working paper, estimate that if E.V. adoption takes off, India will need about 3,400-4,100 Gigawatt hour batteries for its E.Vs by 2035. While E.V. plants are coming up across the country, India is heavily dependent on imports for battery supplies.

The Challenges

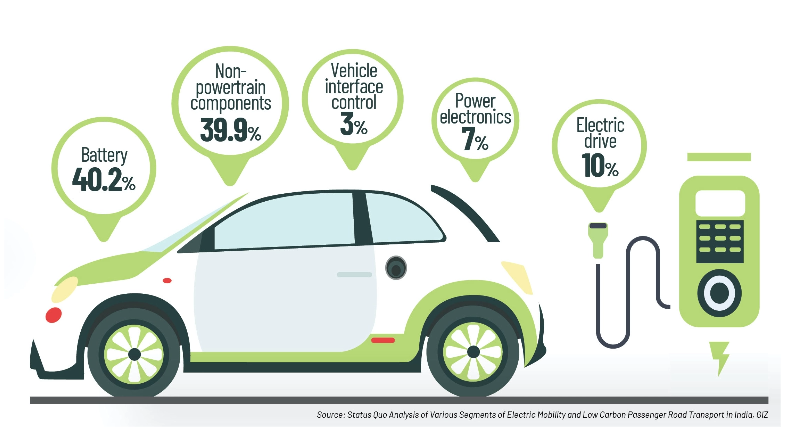

Batteries account for 40% of the cost of an electric vehicle

Many experts believe India should set up giga factories for batteries because they are the critical component in E.Vs, accounting for about 40% of total costs. To win the E.V. game, India has to win the battery game too. And given the centrality of the battery in the cost equation, the prime question is: how to lower the cost of a battery?

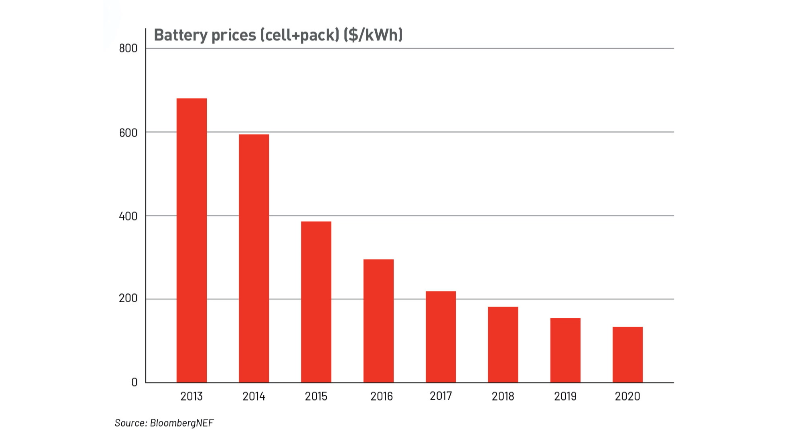

Battery prices have dropped to a fifth of 2013 prices, but need to fall further

Right now, investments into giga factories for batteries are concentrated in China. Beyond China, manufacturing capacity is spreading to Europe and the U.S. Heavy investments made in China have already brought down battery prices, bringing the total cost of ownership of E.Vs closer to vehicles running on conventional fuels. This needs to come down further for mass adoption.

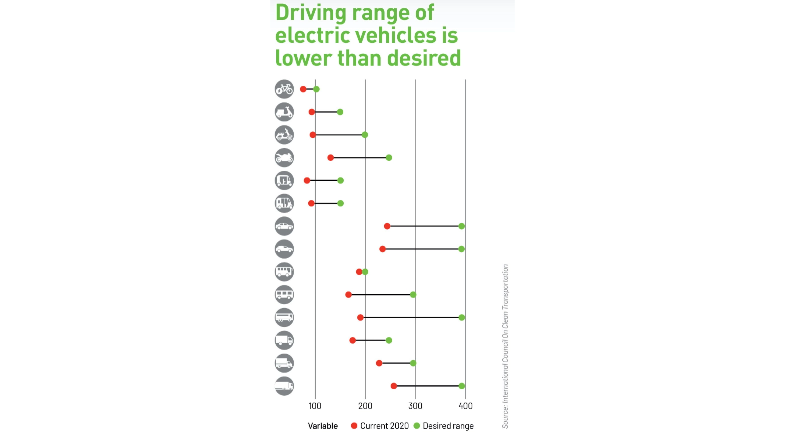

Driving range of electric vehicles is lower than desired

The Next Frontiers

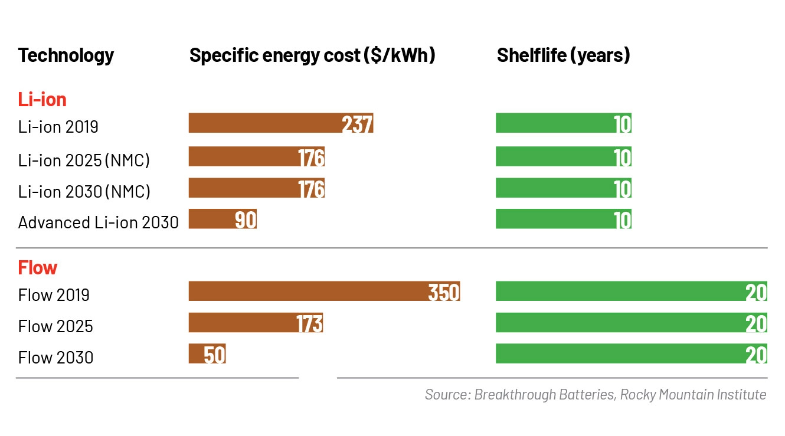

Batteries: Next-generation batteries will cost less and last longer

To address the range issue, battery technology has to progress: both in improving Lithium-Ion batteries, and in developing new materials and approaches. Rocky Mountain Institute projects that costs of Li-ion batteries could drop to $87/kWh by 2025 driven by innovations. It puts battery technologies in three buckets: a) Solid-state batteries such as rechargeable zinc alkaline, Li-metal, and Li-sulfur for heavier mobility applications. b) low-cost and long-duration batteries such as zinc-based, flow, and high-temperature technologies for grid balancing in a high-renewable and future E.V. applications. c) High-power batteries for high penetration and fast charging of E.Vs.

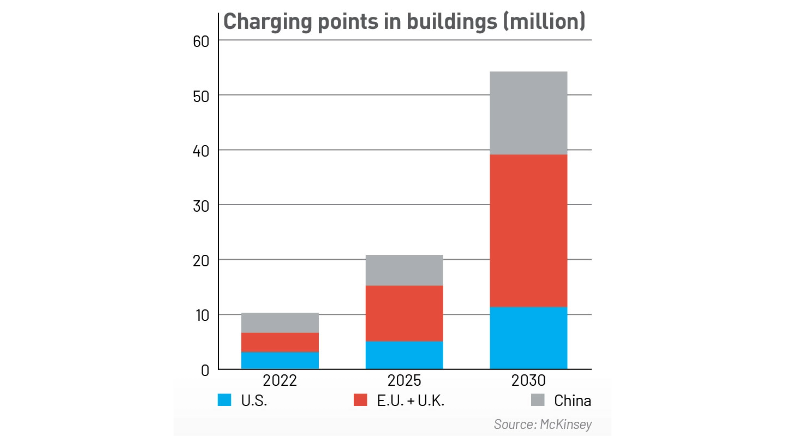

Charging points: 55 million charging stations may be needed by 2030

The growth in E.Vs and batteries should be matched by growth in battery charging infrastructure, which calls for significant investments. According to McKinsey: "An estimated $110 billion to $180 billion must be invested from 2020 to 2030 to satisfy global demand for EV charging stations, both in public spaces and within homes." China, the E.U., the U.K., and the U.S. will need 22 million to 27 million charge-point units by 2025, and at least 55 million by 2030. This is the lower end of the demand. At the upper end, the demand is estimated at 77 million.

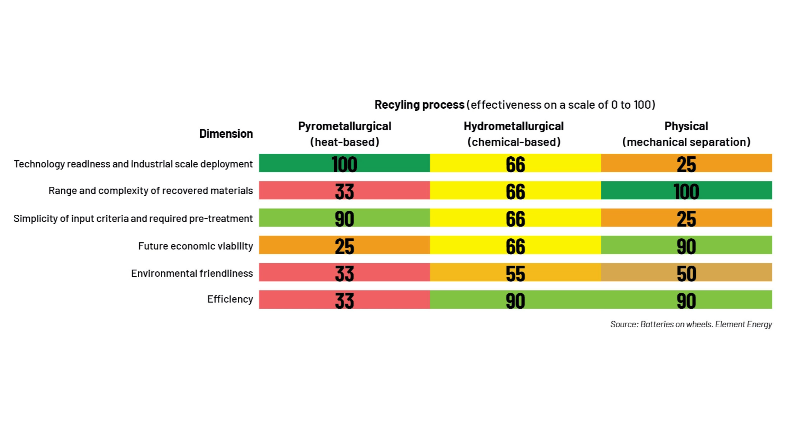

Recycling: Battery recyling processes have varying performance

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH