Uncharted waters

-

- from Shaastra :: vol 04 issue 07 :: Aug 2025

The shipping industry must cut its emissions at sea. Solutions abound in the form of new fuels, transit routes and onboard carbon capture.

Oceans were of interest to Shane Keating even as a doctoral candidate in astrophysics 20 years ago. During his PhD, Keating would apply ideas from oceanography to study the fluid dynamics of stars. "They seem like they're very far apart but actually it's the same mathematics for the two subjects," he says. Decades later, different worlds continue to collide in his work as an Associate Professor of Oceanography and Applied Mathematics at the University of New South Wales in Sydney, Australia. He now combines satellite technology and oceanography to help decarbonise the shipping industry.

"It's an invisible industry that we all rely on. Globally, 90% of everything that we buy is shipped by sea — and that's not going to change anytime soon," he says. What is going to change is how much the industry can emit. The International Maritime Organization (IMO), the United Nations agency which regulates international shipping, is steering the industry towards net-zero greenhouse gas emissions by 2050. Currently, shipping accounts for about 3% of global emissions.

When ships ply the ocean, they take the shortest route possible. But they can save fuel and emit less by using ocean currents to their advantage — even if it means taking a longer route. Keating has been studying ocean currents with an interest in predicting how they evolve in time in order to get better forecasts. The ability to forecast ocean currents, he says, has recently improved through new satellite technology mostly but also artificial intelligence (AI). "I'm actually involved in a satellite called the Surface Water and Ocean Topography (SWOT) satellite." The SWOT satellite, launched in 2022, measures ocean currents with about 10 times higher resolution, Keating says. "That's kind of like going from black-and-white television to ultra-high-definition television in one step."

In 2025, Keating launched his start-up CounterCurrent to provide real-time mapping of shipping routes based on the ocean currents he studies using satellite technology. "If you know where those ocean currents are, you can go with the flow rather than against," the company Founder and Chief Executive Officer says. Keating likens ocean currents to atmospheric weather systems: "Ocean currents vary in time and space in the same way that our weather does... They're formed in the same way that weather systems are in the atmosphere, with high- and low-pressure systems in the ocean and they rotate clockwise or anticlockwise."

For the transition to new fuels to be smooth-sailing, shipowners and governments must think ahead about their storage and availability.

Ships need this information. Currents may work against them or knock them off course. Either way, the ships end up using more fuel. "If you know where those ocean currents are, you can avoid those unfavourable currents. But you can also take advantage of favourable currents — currents that are going in the direction that you want to go in," explains Keating.

To map efficient routes, data from sensors onboard the ship are incorporated into the forecasts along with satellite and modelling data. "The sensor that we've developed also has built-in accelerometers and a GPS. So that gives us the position of the ship, its heading and its motion in space," Keating says. Weather data available from the ships – like wind speed, rain, incoming solar radiation, temperature, air relative humidity and air pressure – are also taken into account. "We have developed a generative AI tool which produces forecasts for individual ships," says Keating. CounterCurrent plans to incorporate other sensors around the vessel in the future, including sensors that measure water temperature and, potentially, the speed of the current with respect to the ship.

"The ships will arrive at the same time as they would have if they just took the direct route, but they use less fuel to do so," Keating says. Mapping more efficient routes doesn't require any modifications to the ship either, unlike, say, wind propulsion for which foldable sails have to be fitted onto ships. "Ocean currents are not very fast compared to wind," according to Keating. But because seawater is denser than air, the momentum in these ocean currents is much greater. "In fact, the momentum in a single ocean weather system, what we call an eddy, is more than a hurricane or a cyclone," he adds.

Keating has tested the prototype onboard a cargo vessel transiting the Tasman Sea and it helped save about 13.4% fuel in the same arrival time. "We have a number of pilot studies coming up this year with a variety of different cargo companies," he confirms.

Utilising eddies to save fuel is one way to decarbonise shipping. Another is switching to low-carbon fuels that emit less CO2 or zero-carbon fuels that emit none.

FUELLING DEMAND FOR ALTERNATIVES

Currently, a majority of the ships (over 95%) use internal combustion engines that are fuelled by petroleum derivatives such as heavy fuel oil and marine diesel. "Any comprehensive effort to reduce emissions will require finding greener fuel to propel vessels across the water," says a 2023 report (mck.co/4kNWbdM). The report, titled The shipping industry's fuel choices on the path to net zero, projects a multi-fuel future. But the switch to greener fuels is likely to be marred by their low availability at ports and high costs, it warns.

Fuel use is evolving with alternatives in the mix, for now.

Tata Steel relies on shipping for the import of raw materials and export of finished goods. While the company doesn't own a shipping fleet and hires ships for maritime transportation, it is the first Indian steelmaker to switch to alternative fuels such as biofuel and liquefied natural gas (LNG) in its vessels.

A fossil fuel widely used in the maritime industry is High Sulphur Fuel Oil (HSFO). HSFO has lots of emission, says Ashish Kumar, Chief Chartering, Operations and Maritime Sustainability, Tata Steel. In 2020, Tata Steel transitioned to a fuel called VLSFO i.e. Very Low Sulphur Fuel Oil. As the name suggests, VLSFO has less sulphur (0.5%, compared to 3.5% in HSFO) but also lower CO2 emissions. Then in 2021, the company started using marine biofuel (used cooking oil methyl ester) as one of its fuels.

"Biofuel cannot be taken 100%; it has to be a blended fuel," says Kumar. "So, we started with a blended fuel called B24, which means that 24% of the fuel is biofuel and the remaining 76% is traditional VLSFO." The company has gone from operating one ship on biofuel in 2021 to now 40 ships. "In this financial year, we want to do more, around 50 ships of biofuel," he says. Being a blended fuel with a base of VLSFO, biofuel is compatible with existing engines.

In 2023, Tata Steel first used LNG to move a cargo of coal on a bulk carrier from Australia. This is a very energy-intensive fuel that has helped reduce carbon emissions, Kumar points out.

For the transition to new fuels to be smooth-sailing, shipowners and governments must think ahead. "First requirement is availability of the fuel that you want to use," says Atul B. Killedar, General Manager, Design Competency Centre, Larsen & Toubro Shipbuilding. Just like for cars on roads, Killedar says, the government made sure that fuels, be it petrol, diesel or CNG, were available in plenty at different locations in each city, new shipping fuels have to be made available at ports. Next is the engines that can use these fuels, adds Killedar. Ships are being designed for the future with dual fuels in mind, he says. But there are other logistical requirements to be met. For instance, LNG, which is natural gas cooled to a temperature of -162°C, requires cryogenic storage. Those things will require additional infrastructure and facilities, says Killedar.

The ongoing Green Tug Transition Program of the Ministry of Ports, Shipping and Waterways, Government of India, aims to replace diesel-powered harbour tugboats with green tugs at major ports. "The first set of tugs will be battery-electric," reads a statement, "with provisions for adopting other emerging green technologies such as hybrid, methanol, and green hydrogen as the industry evolves."

Methanol, ammonia, hydrogen and nuclear are future fuels that will take another 5-10 years, says Kumar. In the meantime, work on technologies that capture emissions from ships is going ahead at full steam.

ALL ABOARD

William Berelson, a Professor at the University of Southern California (USC), and his colleague Jess Adkins, a Professor at Caltech, had been working on the natural carbon cycle of the ocean for many years. "The question we were interested in was simply how fast does the ocean neutralise CO2 by reacting dissolved CO2 in the ocean with calcium carbonate that's naturally in the ocean as well," says Berelson. Over drinks one day, the two discussed the possibility of starting a business based around this natural reaction.

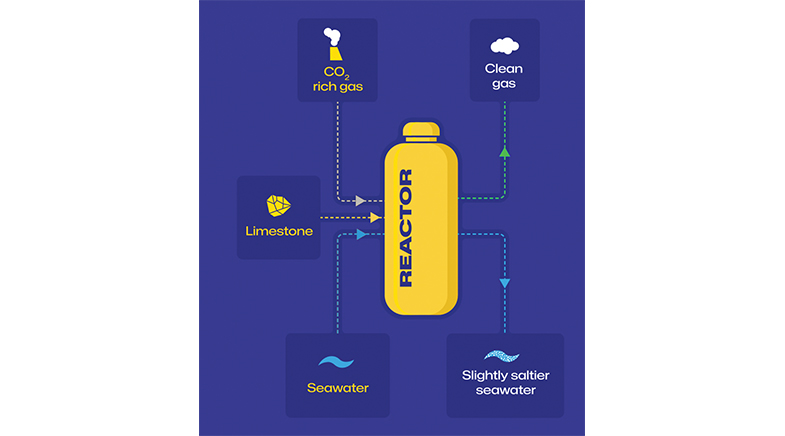

In 2022, along with their Caltech colleague Pierre Forin, Berelson and Adkins co-founded Calcarea. The company has developed a carbon capture and sequestration system for ships. Their reactor unit captures carbon dioxide from ship engine exhaust and neutralises it using limestone (calcium carbonate) and seawater. "You can take CO2 from the exhaust gas, dissolve that in seawater, let that seawater sort of percolate through a bed of limestone," says Berelson. It's like making coffee every morning, he says. "You just let that water move down through the grains." When limestone dissolves, what comes out is water that has a little bit more calcium and bicarbonate in it.

The chemical reaction goes like this: CO2 dissolves in seawater (H2O) to form carbonic acid (H2CO3), which then reacts with calcium carbonate (CaCO3) from the limestone forming calcium ions (Ca2⁺)) and bicarbonate ions (HCO3⁻). "Bicarbonate is a form of alkalinity," says Berelson. The water with the added alkalinity will be released into the ocean. "It's not adding alkalinity to the ocean to try to suck up CO2 from the atmosphere into the ocean. It's already reacted with the CO2."

After testing the pilot reactor in laboratory experiments on the USC campus, Berelson and colleagues ran computer models showing that the carbon capture mechanism would work at a larger scale on board container ships. Their work, published in Science Advances in June (bit.ly/shiplime), models 50% carbon dioxide emissions reduction along a Pacific shipping lane over a decade.

"We did a simulation of this happening over 10 years running from China to Los Angeles and a [few] hundred ships making this route all the time — all the time dumping the effluent from our reaction, and we modelled what is actually going to change," says Berelson. The surface alkalinity and dissolved inorganic carbon (a sum of carbonates, bicarbonates and dissolved CO2) along the shipping route increased by less than 1.4% after a decade. That is about 30 µmol/kg, the study reports.

The amount of alkalinity doesn't change throughout the entire ocean, just along the route, Berelson clarifies. "The pH of the ocean really doesn't change at all." Nonetheless, researchers will monitor changes to the ocean. "If we do nothing and CO2 continues to increase in our atmosphere the ocean ecosystem is definitely going to change," Berelson cautions. "It's already changing."

Calcarea next plans to test its carbon capture technology onboard ships and is in talks with shipping companies. "We know now how to scale up this very simple reaction to the kind of quantities that would be reacting on a ship," Berelson says. The onboard demonstrations may begin in 2026.

While full-scale implementation costs will depend on the size and speed of the vessel, and the amount of fuel it burns, Berelson says that for the device to get built and installed on a ship is going to cost certainly over a million dollars. Per tonne of carbon sequestered, the cost could be somewhere between $100 and $200.

For the start-up with four full-time employees, it's all hands on deck.

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH