A green light for energy transition

-

- from Shaastra :: vol 04 issue 10 :: Nov 2025

India has to take a multi-pronged path, embracing technology and alternative power sources, to meet its future energy needs.

Two simple notions capture India's future energy landscape. The first assumption, which is also a goal, is that India will be a developed country by the middle of the century. The second theory, based on current and historical data, underlines the relationship between energy use and development, with per capita energy consumption increasing linearly with economic growth. Put these two concepts with some statistics together, and the conclusion is inescapable: India's energy use per capita will increase four times in the next 25 years.

Like most other nations, however, India has committed to reducing its greenhouse gas emissions. A 2024 study supported by the office of India's Principal Scientific Advisor and the Nuclear Power Corporation of India modelled four trajectories that India can follow to achieve its goal of net zero by 2070: thrust on nuclear energy; thrust on fossil fuels with carbon capture; thrust on renewable energy; and a scenario which integrates all of these. It found that India would require a minimum of 78 gigawatts (GW) to a maximum of 331 GW of nuclear power, irrespective of the path it chooses. According to the report, if India focuses on nuclear energy, it will achieve the cheapest possible electricity rates and a maximum reduction in carbon dioxide emissions.

India is not the only country that faces this dilemma. Major nuclear energy producers, such as Japan, South Korea, and Belgium, had scaled back their nuclear energy programme after the 2011 Fukushima disaster in Japan. However, they are all now building nuclear reactors. Germany, which shut down its nuclear reactors, has seen a rise in its use of fossil fuels and an increase in electricity prices since then. The country is now debating when and how to build new and modern nuclear reactors. In 2023, more than 20 countries from four continents launched a declaration to triple nuclear energy capacity (bit.ly/Nuclear-Capacity). A year later, India also announced its intention to triple its nuclear power generation capacity by 2030 (bit.ly/India-Aim).

Since the government alone will find it difficult to build such a large amount of capacity within a short span of time, the situation is tailor-made for nuclear energy start-ups. "India is a population-dense country, and so we require some solutions which are energy-dense," says Samyak Munot, Co-founder and Chief Technology Officer of IYNS Tech Solutions, a nuclear energy start-up.

Anil Kakodkar, former Chairman of the Atomic Energy Commission, however, says that limited uranium reserves will be a problem if India wishes to produce more nuclear energy. He believes that just as the country faces an energy security challenge with hydrocarbon because most of it is imported, it will face a similar problem with nuclear energy. "The way out is to move to thorium as fast as we can," he suggests. The lengthy timeline of nuclear energy projects is also a concern; it will take nearly a decade before significant amounts of nuclear energy are fed into the power grid.

If India focuses on nuclear energy, it will achieve the cheapest possible electricity rates and the maximum reduction in CO2 emissions.

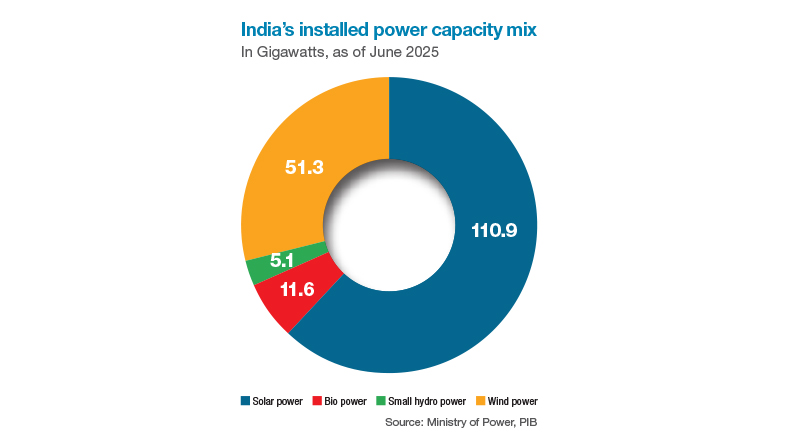

Till then, the country will continue to increase its renewable energy capacity. Currently, nuclear energy's contribution to India's total installed power capacity of 476 GW is only 1.8%, while solar energy accounts for 23.3%, wind energy for 10.8%, biopower for 2.4%, large hydro and small hydro for 11.2%, and coal for around 50.5% (bit.ly/Energy-Breakup). Falling costs and increasing efficiencies of solar modules and wind turbines, along with financial incentives and the National Solar Mission, helped the country nearly triple its installed renewable energy capacity, from 76.37 GW in 2014 to 226.79 GW by 2025 (bit.ly/Capacity-Increase). Non-fossil fuel sources now account for 49% of the country's total installed capacity. However, this pace of increase is expected to slow down over the next decade.

THE LAND CONSTRAINT

Over the last decade, India has expanded its renewable energy capacity by utilising large areas of land to develop power parks, such as the Bhadla Solar Park in Rajasthan, the Pavagada Solar Park in Karnataka, and the Muppandal Wind Farm in Tamil Nadu. These projects have demonstrated that land acquisition is a troublesome and time-consuming process. Such large projects are often located in remote areas of the country, and, therefore, transmission line development and power loss during transmission are expensive and wasteful. Apart from using nuclear technology, there are two solutions to this problem: increasing the efficiency of solar cells so that less land is required for the same output, or adopting designs that minimise or negate the need for land.

Prices of electricity from renewable sources have dropped, but renewables cannot replace coal because they produce electricity intermittently.

Soumitra Satapathi, a solar energy specialist and Professor of Physics at the Indian Institute of Technology (IIT) Roorkee, who is working on increasing the efficiency of solar cells, points out that contemporary solar cells used in India can deliver an efficiency of 22-23%. The country, however, currently uses poly- or monocrystalline solar cells, with efficiencies of 16% and 19%, respectively. More efficient cells are now entering the market. Technologies such as floating photovoltaics (PV), building-integrated photovoltaics, and agrivoltaics are also on the horizon, with potential capacities of 207 GW, 309 GW, and 3156 GW, respectively (bit.ly/Cell-Potential). Satapathi adds that there is an opportunity to incorporate solar technology into upcoming buildings.

Advances in lightweight materials, anchoring systems, and digital monitoring help make floating power plants feasible and effective. India has three major operational floating PV plants, and at least 17 floating power plants have been commissioned or are in different phases of implementation. With a long coastline, India has high potential for offshore wind, but the costs are steep. The government, therefore, is currently providing viability gap funding to offshore wind projects.

The rooftop solar mission continues, and new incentives include building-integrated photovoltaics for consumers with limited rooftop space. Innovations in thin film and transparent solar cells that blend into facades and windows are helping to tap this potential. Like solar panels, wind energy systems are also making their way to rooftops. Unique vertical-axis turbine designs, low-cut-in-speed generators, and smart power electronics have enabled start-ups such as the Surat-based SUNWIND Innovative and the Hyderabad-based Archimedes Green Energys to install wind energy systems in buildings.

The government is experimenting with agrivoltaics, which involves installing solar panels above farms. India currently has more than 20 such plants. Smart tracking systems, optimised panel designs, and sensor-based farm management are being used to ensure that solar photovoltaics on farmland do not decrease productivity. Also in the works are solar panels along expressways that can generate electricity and feed it to nearby electric vehicle (EV) charging stations.

THE INTERMITTENCY CHALLENGE

Over the last decade, the prices of electricity from renewable sources have dropped significantly. Currently, the cost of solar electricity is ₹2.5 per unit, while wind electricity costs around ₹3 per unit. Electricity from coal now costs ₹4-6 per unit. Despite such competitive rates, renewables cannot replace coal because they produce electricity intermittently. Current storage systems cost ₹7 per unit, increasing the overall cost of solar or wind electricity. Renewable energy systems do not work unless 15-25% of the electricity generated can be stored. The challenge for the rest of this decade is to develop energy storage systems that are scalable, low-cost, efficient, and can store electricity for extended periods without degradation. The systems need to respond quickly to balance sudden fluctuations in solar and wind output and maintain grid stability.

While lithium-ion batteries currently dominate the energy storage market, various types and technologies are being developed worldwide. These include mechanical storage systems, such as pumped hydro, compressed air, and flywheels; electrochemical or chemical storage systems, including batteries, hydrogen, and synthetic fuels; and electrical storage systems, such as supercapacitors. Chemistries are being tested to find good alternatives to lithium-ion batteries. Another way of minimising energy storage is by having a wide electricity grid. A grid that connects remote locations enables balancing the different renewable energy production profiles of disparate regions and stabilises the supply. Nations are attempting to expand their grids across borders through the global programme 'One Sun One World One Grid'. India is in talks with Oman, the United Arab Emirates, Saudi Arabia, the Maldives and Singapore under this initiative.

Combining renewables can also stabilise the supply to a certain extent. For example, solar energy peaks during the day, and wind power blows more at night and in the early morning. Both plants can then share infrastructure such as transmission lines and energy storage. The government provides incentives for such designs. The country has commissioned 1.44 GW of wind-solar hybrid capacity in these plants, with a 30 GW plant planned in the Kutch region of Gujarat. Similarly, combining solar power with biomass ensures a steady supply of electricity and such hybrid power plants are also being developed by the New Delhi-based Husk Power Systems and other start-ups.

SUPPLY CHAIN RISKS

India has rapidly expanded its renewable energy capacity through the large-scale import of solar cells and modules, as well as battery cells and packs. "Most of the industries in India were module manufacturing companies; there were hardly any cell manufacturing companies," says Satapathi. Policies have led to a change: imports of solar cells and modules declined by 20% and 57%, respectively, in the first eight months of 2024-25 (bit.ly/Imports-Decline). The major manufacturers are TP Solar, Reliance Industries, Waaree Energies, Vikram Solar, Gautam Solar, AD Solar, and ReNew.

The downside of manufacturing renewable energy systems is the supply bottleneck: an inconsistent supply of critical minerals such as silicon, rare-earth metals and lithium. As the known reserves of minerals are limited and often controlled by companies, there is always a risk of price fluctuations and disruptions to supply chains. Now, the National Critical Mission is addressing this challenge by promoting the exploration, mining, processing, and recycling of critical minerals. Many of the clean energy equipment deployed during the early phases of the renewable energy expansion are now reaching the end of their lifecycle and therefore need to be recycled. Solar waste is expected to rise sharply after 2030. Current policy requires manufacturers to ensure the collection, recycling, and proper disposal of their products. Similarly, the Battery Waste Management Rules 2022 require manufacturers to recycle batteries.

"It (energy transition) is a mathematical problem of security, reliability, availability, environmental constraints, carbon impact, etc.," says H.P. Khincha, former Professor of Electrical Engineering at the Bengaluru-based Indian Institute of Science. He also says that the transition is an optimisation problem, as matching energy demand and supply with renewable sources requires optimising various energy-producing technologies, such as thermal, hydro, nuclear, biomass, and hydrogen power. Hinting at alternative routes to net zero, he says that India can continue to burn some carbon and offset it through afforestation and carbon absorption technologies.

Artificial intelligence (AI), the internet of things, blockchain, and digital twins can help India's clean energy journey, making energy generation smarter and energy use more efficient. These technologies can optimise the performance of renewables and forecast their generation. Smart meters, sensors, and AI-driven automation will reduce energy waste in buildings, industries, and appliances and smart grids, digital platforms and blockchain will balance supply-demand, enable peer-to-peer trading, and integrate distributed resources such as EVs.

Energy-dense generation technology, cost-effective storage, and access to raw materials for clean energy equipment are the three main goals that India needs to meet to achieve its objective of a clean and green economy. In the following few stories, Shaastra will wade deeper into some of these challenges and opportunities.

Also read

The sun shines on solar farming

Turning up the heat

A clean-energy case for going nuclear

Power to the people

Dawn of a solar decade

While the sun shines

Growing green

Hold in store

More clear about nuclear

Rare earth calling

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH