Rare earth calling

-

- from Shaastra :: vol 04 issue 10 :: Nov 2025

The quest for green energy has upped the demand for critical minerals, sparking innovation.

Amit Priyadarshan and Anandh Mathew were in the fourth year of their Petroleum Engineering course at the Shillong-based University of Technology and Management when they conceived their first product for the oil industry: a microbe-based bioresin that, when pumped into oil wells, prevents sand from clogging the wells. This idea earned them a grant of ₹1.7 crore for R&D from Oil India, and they went on to set up a company called Caliche Global in Guwahati. After the product was commercialised, they looked for other problems to solve in the petroleum industry. Indian companies then were licensing oil discovery software from abroad, paying hefty fees. The Caliche founders knew that Indian oil companies would be reluctant to drill based on untested software, but they also realised that a product trained on Indian data would be more accurate and relatively safe from a strategic and defence point of view.

The company developed software based on machine learning algorithms for oil discovery, and to process seismic data created by sending sound waves into the ground and recording the reflected values. In 2023, when Priyadarshan realised that the Indian government was seeking software for the discovery of critical minerals, he decided to modify the software to facilitate the detection of rare-earth metals underground.

Geological data are a prerequisite to developing such software. Caliche's team collaborated with the Geological Survey of India (GSI), which has extensive data combined from magnetic, gravity, radiometric, and seismic surveys. This data included information on the nature of soil, stream sediments, and rock chemistry used for detecting mineral anomalies, as well as data that showed rock types, structures, and formations across various regions. The company utilised eight such datasets to train the machine learning algorithm to predict the likelihood of rare-earth deposits in a specific area. Following some positive test results, the company is working to expand the software to identify other critical minerals, such as lithium.

Caliche is among a new breed of companies using digital technologies to aid the exploration and processing of critical minerals. Bengaluru-based Squadrone Infra and Mining and Hyderabad-based Marut Drones have developed mineral exploration drones equipped with magnetometers and hyperspectral or LiDAR sensors to narrow down locations of mineral deposits. Inside the mine, IoT (Internet of Things) communication systems, such as those developed by Ahmedabad-based Dyulabs, help streamline operations. "AI (artificial intelligence) is now changing the game," says Biplob Chatterjee, Chief Executive Officer of Kolkata-based Geovale Services, a firm doing mineral and water exploration and consulting. "It (AI) is able to look at the data in a far superior way, and that's going to impact both the upstream end and the downstream end of mineral exploration, mining and ore processing."

CRITICAL CONUNDRUM

Critical minerals are a key component of the renewable energy economy, serving a function similar to that of oil during the Industrial Revolution. They are essential for making batteries, solar panels, wind turbines, and the electronics components that drive modern economies. Just as oil's distribution drove the world's geopolitics in the last century, critical mineral deposits are shaping current geopolitics. Only a few countries possess significant reserves of these critical minerals or the technologies necessary to process them. The Democratic Republic of the Congo, for instance, has more than 50% reserves of cobalt, which is used in batteries. China has extensive reserves of rare-earth elements, which are essential for producing magnets used in electric vehicles (EVs) and wind turbines. Chile has almost 40% of the world's lithium reserves. Most countries never invested in technologies to explore, mine, process and refine these minerals. China, the only country to have invested heavily in such technologies in the late 1990s, is now the leading exporter of critical minerals.

The concentration of large reserves and processing capabilities in a few countries is a potential supply chain risk, and major economies are therefore scrambling to accelerate exploration efforts for energy security. India launched the National Critical Mineral Mission in 2025 and has now shortlisted 24 minerals for exploration and mining. The GSI has 1,200 exploration projects planned from 2024-25 to 2030-31. Exploration programmes by GSI have identified 5.9 million tonnes of lithium ore in Reasi, Jammu and Kashmir, 0.67 million tonnes of rare-earth minerals with a grade of 0.19% in West Bengal's Purulia district, 13.79 million tonnes of vanadium in Arunachal Pradesh, and 5,737 million tonnes of limestone in Meghalaya.

To develop critical mineral technologies, seven centres of excellence have been set up in the country, at leading research institutions such as the Indian Institutes of Technology (IITs) and the Council of Scientific & Industrial Research (CSIR). Preliminary estimates indicate that 380 million metric tonnes of polymetallic nodules comprising copper, nickel, cobalt and manganese are available in the Central Indian Ocean Basin. The Chennai-based National Institute of Ocean Technology is developing deep-sea mining systems, including crawler collectors and submersible vehicles, to explore polymetallic nodules rich in critical minerals.

While these deposits appear significant, Chatterjee believes that India needs to substantially increase investments in critical mineral discovery due to the substantial volume of critical minerals required for the green energy transition. "For the last 5,000 years, whatever copper we have produced, in the next 50 years, we need more than that if we want to transition," he says. However, the process of starting exploration to securing the processed and refined minerals is long and arduous. "Even by 2035, we are not going to see much of a significant impact. We will still be looking at China and other countries to provide us with our resources," he adds.

THE CIRCULAR APPROACH

While exploration continues, countries are also developing recycling capacities for critical minerals. India, for example, has a budget of ₹15,000 crore for incentive schemes to expand recycling capacities. Such schemes involve either tax breaks or subsidies for projects. This will serve a dual purpose: reduce the imports of critical minerals and address the issue of accumulating e-waste.

At the CSIR's National Metallurgical Laboratory (NML) in Jamshedpur, Senior Principal Scientist Sushanta Kumar Sahu, a PhD in metallurgy, has been working to streamline processes for the recovery and recycling of critical minerals. There are two ways of recovery. One is to shred the waste and separate the minerals using magnets or gravity. The other method is to heat the waste so that one constituent with a low melting point separates, or chemically treat it so that the constituent insoluble in the chemical is recovered. Sahu's group is developing processes for three rare-earth minerals — neodymium, praseodymium, and dysprosium — from scraps of magnets used in EV rotors, wind turbine generators, hard drives, and other applications. These magnets contain iron in high concentrations, making it challenging to recover rare-earth elements. Sahu's group has a method that converts rare-earth elements to their chloride form and iron to its oxides. While iron oxides are solid, rare-earth chloride in a water solution can be leached out with 99% purity. The technology is currently at Technology Readiness Level 7.

Sahu's group has developed several recovery techniques for extracting samarium and cobalt from spent samarium-cobalt magnets, as well as cerium, neodymium, and lanthanum from nickel-metal hydride batteries. Many Indian start-ups have developed patented processes to recycle lithium from batteries. Bengaluru-based Metastable Materials has a chemical-free method to recycle copper, aluminium, cobalt, nickel and lithium from batteries using heat and mechanical density-based processes. Similarly, Noida-based Lohum claims that it can process over 25,000 metric tonnes of critical materials annually through its patented 'NEETM' recycling/extraction technology, a multi-stage hydro-metallurgy-based process. Researchers are also recovering critical minerals from industrial waste. For example, scientists from the Mumbai-based Bhabha Atomic Research Centre (BARC) have developed a process to recover rare-earth elements from coal fly ash, a powdery by-product of coal combustion.

Critical minerals are valuable because of their unusual properties. Neodymium packs high magnetic strength in a small size, and dysprosium improves magnet stability at high temperatures, a useful property for making powerful EV motors and wind turbine generators. Lithium is the lightest metal in nature and therefore provides the highest energy density per unit weight, a property that makes it apt for electric vehicle batteries. Similarly, cobalt improves battery lifespan and stability in lithium-ion batteries, and nickel increases battery energy density, enabling longer-range electric vehicles. Copper, the best conductor after silver, is used for wiring in power grids, windings in motors and generators, solar panels, and charging infrastructure.

TECHNOLOGY TO THE FORE

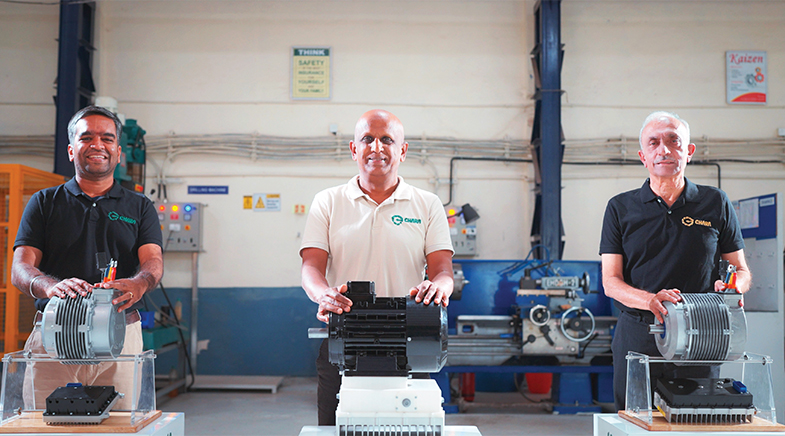

To reduce the supply chain risks of these minerals, researchers and start-ups are experimenting with material substitution, redesigning technology, or developing new technologies that do not require critical minerals. Bengaluru-based Chara Technologies, set up in 2019, has designed a rare-earth-free motor. Motors that convert electrical energy into motion are at the heart of EVs, a key component of the green energy transition. Two types of motors are mostly in use now. One is the induction motor used in fans, pumps, conveyors and compressors. This is low on efficiency. The other is the brushless DC motors used in electric vehicles, which derive their torque from permanent magnets containing rare-earth minerals.

Technologies are being developed around the world to enhance the process of critical mineral exploration, mining, extraction and processing.

Rare-earth mining and processing are hazardous to the environment. Rare earths are present in low concentrations in ores, and therefore hundreds of tonnes of rocks need to be mined to extract one tonne of rare-earth minerals. This process also involves the use of toxic chemicals and the production of radioactive by-products, which pollute the environment. "There are three ways to solve this problem. We can also start mining and extraction and make magnets; second is to try to find technologies to build magnets without using rare earths; and third is technology like ours," says Bhaktha Keshavachar, Founder and CEO of Chara Technologies.

To create a substitute motor for EVs, the company's R&D team decided to modify a known technology called the Synchronous Reluctance Motor (SynRM) by addressing issues such as poor starting torque, and noise. Unlike motors that use strong rare-earth magnets, SynRMs have a rotor (the spinning part) made of layered steel sheets with slots cut in them.

By smartly shaping the rotor's steel, it is made to spin powerfully in the presence of a magnetic field without the expensive, rare-earth permanent magnets. This motor system, combined with an intelligent controller and software, makes it highly energy-efficient. Keshavachar says that as the manufacturing and volumes pick up, these motors will become price-competitive.

Like Chara Technologies, Pune-based Conifer, Chennai-based Viridian Ingni Propulsion, and Bengaluru-based Numeros Motors have also developed rare-earth-free motors.

Apart from motors, start-ups are working on developing batteries free of critical minerals. Lithium-ion batteries are the poster child of batteries, but have critical minerals such as lithium, cobalt, nickel, manganese, and graphite. Coimbatore- and Singapore-based Sodion Energy and Roorkee-based Indi Energy are creating sodium-ion batteries that do not require lithium, cobalt and nickel. Similarly, Hindustan Zinc, in collaboration with IIT Madras, is developing zinc-based batteries for EVs that would not require lithium, cobalt and nickel. Bengaluru-based Nash Energy has developed lithium-iron-phosphate cells that do not require cobalt and nickel.

Technologies are being developed around the world to enhance the process of critical mineral exploration, mining, extraction and processing. A leading example is Lilac Solutions, based in Oakland, California, which utilises direct lithium extraction technology that involves an ion exchange with ceramic beads to extract pure lithium from brine. This is quicker than the conventional lithium extraction method, which requires evaporation for months in ponds. REEgen, based in Ithaca (in the U.S.), has engineered bacteria to recover rare-earth elements from slag and e-waste, making the recovery process more environmentally friendly.

There are three ways to reduce critical mineral imports without disrupting the clean energy transition, and all require technologies: one is to utilise technologies to explore, mine, process, and refine critical minerals. The second is to utilise technologies to recover critical minerals from waste, and the third is to employ technologies that can operate without critical minerals. In the quest for clean energy, researchers and companies are exploring new avenues.

Critical minerals are a common nerve that affects all green energy technologies and hence forms the foundation of a green energy future. In this world of geopolitical instability, owning critical minerals not only promises a stable energy supply but also provides leverage in geopolitics.

Also read

Best out of waste

Towards indoor solar

Breaking ground

The EV roadblock

Growing green

A green light for energy transition

Hold in store

More clear about nuclear

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH