A bird's-eye view of drones

-

- from Shaastra :: vol 03 issue 03 :: Apr 2024

A bird's-eye view of a nascent drone industry that is taking wing and is being harnessed in a variety of civilian and military applications.

howindialives.com

howindialives.com is a database and search engine for public data

The ongoing Russia-Ukraine war has seen a significant increase in the use of drones in reconnaissance and direct combat, marking it as the first full-scale drone war. However, the use of drones extends beyond warfare. They have been harnessed for a longer time in various civilian applications ranging from monitoring crops and livestock to surveying properties, mapping terrains to delivering packages, including medicines in emergency situations.

THE FLIGHT PATH

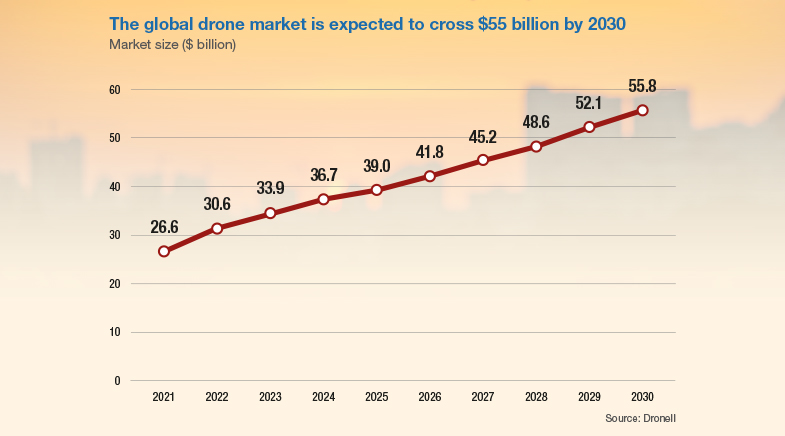

The global drone market is estimated to grow from $26.6 billion in 2021 to $55.8 billion by 2030, according to DroneII, a drone industry data provider. The market is spread across defence, administration, development, research, enterprise and consumer segments. According to estimates by data service provider Statista, consumer demand for drones was expected to have crossed 7.6 million units in 2023, from 4.6 million in 2018.

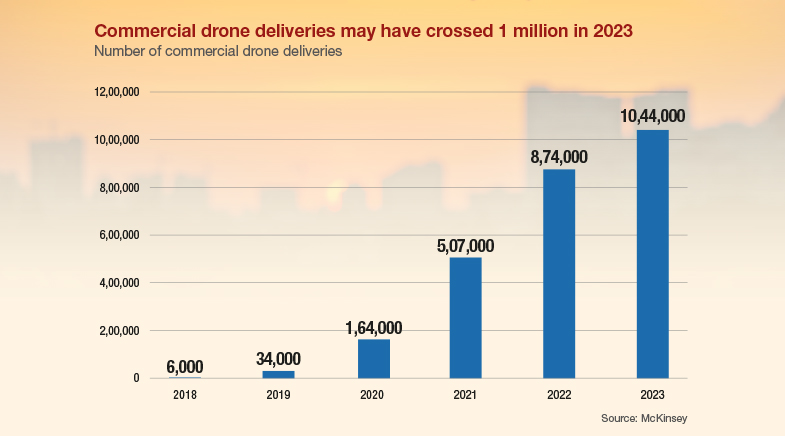

Usage has been going up despite regulatory and technical factors that inhibit it. According to management consultancy McKinsey, the number of drone deliveries likely crossed 1 million in 2023, up from a mere 6,000 in 2018. More than 10 drone operators did over 5,000 commercial deliveries each in 2022. Usage is expected to pick up as drone deliveries become cost-competitive with other means such as by electric cars, vans and internal combustion engine vehicles.

THE PROPELLERS

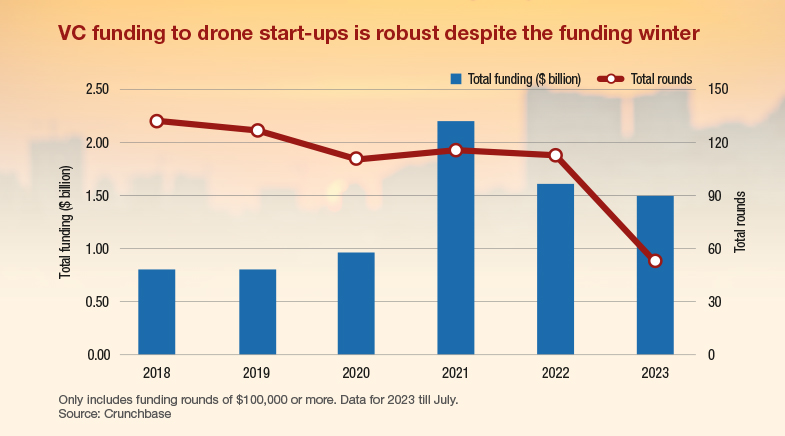

Drone start-ups such as California-based Zipline argue that drone deliveries are better for the environment compared to deliveries by traditional modes of transport. Zipline has raised over $1.1 billion from venture capital funds since its inception. While tech start-ups in general are facing a 'funding winter', drone start-ups are doing better. They had raised $1.5 billion by July 2023, against $1.6 billion in all of 2022.

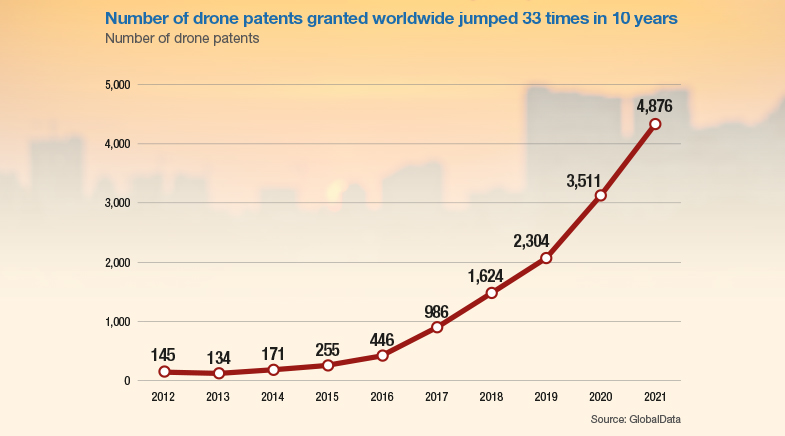

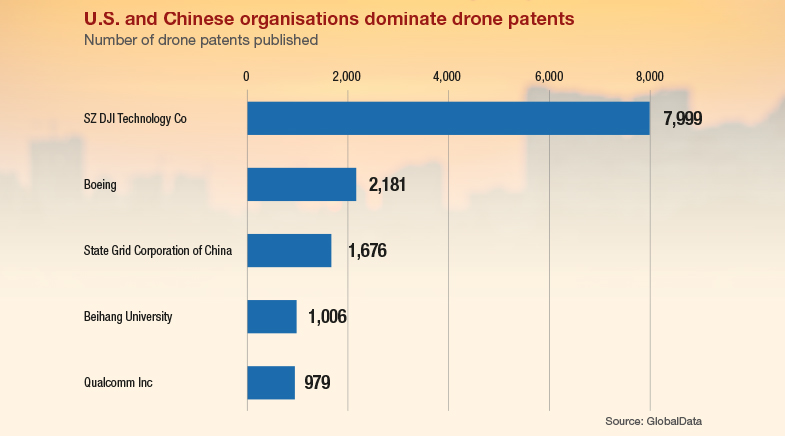

One area they are investing in is innovation, an expression of which is the number of patent filings. More patents reflect new capabilities, features and performance improvements in drones. It also indicates rising commercial interest and investments in drones. The number of patents granted for drones worldwide has seen a significant increase over the years. In 2021, 4,876 patents were filed, up 39% from the previous year, and a three-fold increase over a three-year period. The ownership of patents also reflects the biggest markets for drones today: the U.S. and China.

THE INDIAN LANDSCAPE

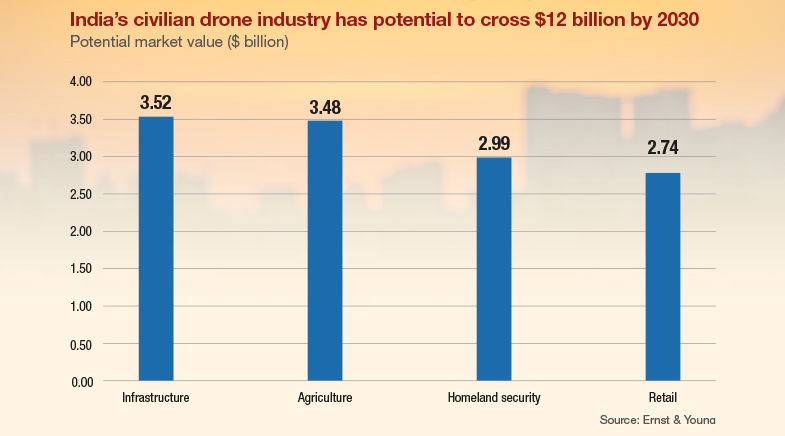

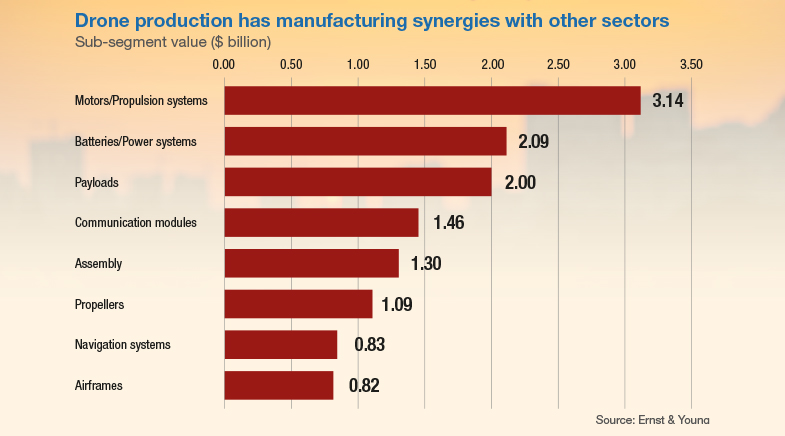

India aims to become a global hub for drones by 2030. According to an analysis by Ernst & Young, India's civil drone segment alone, comprising commercial and homeland security, has a market potential of over $12 billion by 2030.

India's interest in drones is spurred not only because of the value it could add to industries such as agriculture and retail, but also because it could spur manufacturing. Many components that go into drones are aligned to other sectors such as consumer electronics, automobile, and aviation. That could strengthen the manufacturing ecosystem and provide jobs.

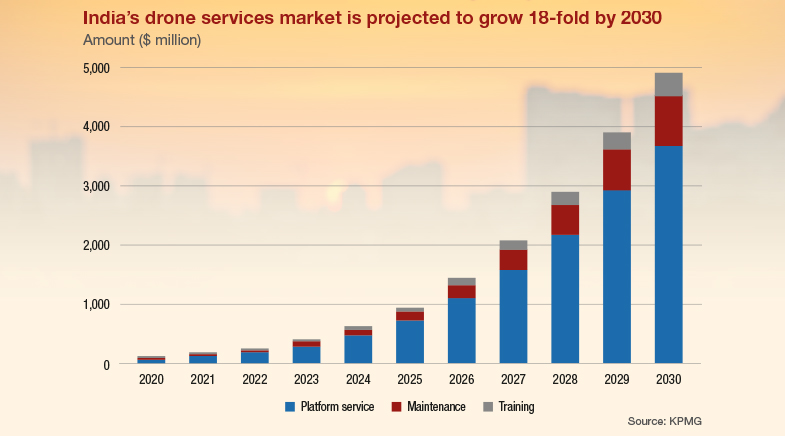

Emerging business models, such as drones-as-a-service, are expected to expand and strengthen. "The price of an enterprise-level drone can be incredibly expensive, which is why most companies are opting for drones as a service," KPMG noted in a 2022 report. Drones-as-a-service is important, especially for countries like India, since it allows a range of organisations to access drone technology without large upfront costs. This enables a wider range of groups to leverage drones for development goals like medical delivery, agriculture monitoring, and disaster response.

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH