Raising their generics game

-

- from Shaastra :: vol 01 issue 01 :: Jan - Feb 2022

Complex drugs going off-patent in the U.S. means more hoops for Indian pharma companies to jump through. But they are up for it.

On the face of it, it was business as usual. In August 2020, pharmaceutical company Dr Reddy's launched its generic or off-patent version of Ciprodex, a branded drug for ear infections, in the United States. Indian companies are old hands at producing off-patent drugs and hold a 40% volume share in the U.S. generics market. Replacing expensive, patent-expired brands with cut-price generics saves the American healthcare system billions of dollars.

But generic Ciprodex is not your average generic. It is a combination of the antibiotic ciprofloxacin and the steroid dexamethasone in suspension form, given as drops into the ear, the so-called otic route. For such drugs, the gold standard method used by generic drug makers to show bioequivalence (BE) to a reference drug, such as the innovator's, does not work. This method compares blood levels of the generic and reference drug in two groups of healthy volunteers to establish the sameness.

Proof of BE is key to the generic being approved as therapeutically equivalent (TE) to the reference drug. While novel drugs undergo lengthy and expensive clinical trials to show safety and efficacy, for TE generics, the regulator relies on the safety and efficacy of the reference drug. This allows generics to be developed faster at lower costs - and to be substituted freely for innovator brands.

But Ciprodex and its generics act in the ear and do not enter the bloodstream. "If you cannot test BE through the blood sample, how do you know you are equivalent (to the innovator drug)?" asks Sauri Gudlavalleti, Head of Integrated Product Development Organisation, Dr Reddy's.

"A decade ago, hiring a liposomal formulation expert was virtually impossible in India. Now, the pool of talent has grown."

In 2013, the U.S. Food and Drug Administration (USFDA) required generics of Ciprodex to undergo a clinical trial. A standard BE study takes a maximum of two months to complete, but a clinical trial can take a year or more; trial sites have to be identified and subjects recruited, says Surinder Kher, a Bengaluru-based clinical development expert. Its cost is many times that of a BE study.

Instead of a clinical trial, Dr Reddy's proposed an alternative approach: a rigorous in vitro analysis that would enable faster filing. The Hyderabad-based company had earlier used this approach to become the first to get a USFDA approval for a generic azacitidine suspension injection, an anti-cancer drug. But the USFDA rejected this approach for generic Ciprodex. But more of that later.

The case of generic Ciprodex exemplifies the challenges facing Indian generics companies as complex drugs come off-patent in the world's largest pharma market. Demonstrating the sameness of such products with the reference drug is "a whole new ball game", says Sukhjeet Singh, Chief Scientific Officer at Sentiss Pharma, in Gurugram, which is readying a pipeline of ophthalmic drugs for the U.S. These face similar hurdles in proving BE as the otic ones.

For complex generics, the process starting from identifying an opportunity to getting an approval can take almost a decade, compared with the 3-4 years needed for an ordinary generic, and entails back-and-forth discussions with the USFDA. It took Hyderabad-based Natco Pharma (and U.S. partner Viatris) 8-9 years before it could, eventually in 2017, market generic Copaxone, a complex Active Pharmaceutical Ingredient (API) formulated as an injectable for relapsing forms of multiple sclerosis. This also makes it an expensive pursuit.

Equally, though, this is an opportunity. With the right mix of R&D skills, capabilities and investment, a company can reach the finishing line first and enjoy a window of attractive pricing with few rivals in the otherwise stiffly competitive landscape. Upon approval, Dr Reddy's generic Ciprodex was the first in a market where annual Ciprodex sales were roughly worth $450 million, according to healthcare data science company IQVIA. Complex generics offer "a lucrative market" for drug manufacturers, according to a 2016 IQVIA white paper. "But only if they can adapt to a more complicated and challenging development process."

CAUTIOUS APPROACH

The shorter approval pathway for generics in the U.S., in place since the 1980s, has worked well for most products: small molecules mostly in a tablet or capsule form that are relatively simple to reverse-engineer, produce and test for equivalence. But more sophisticated drugs are going off-patent.

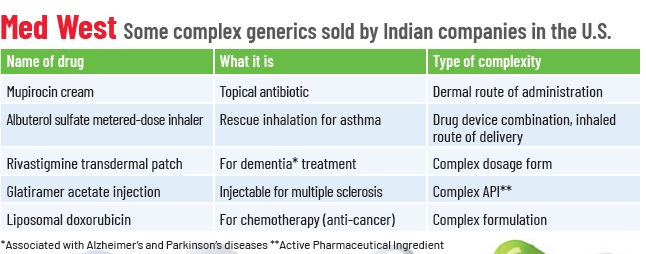

These include drugs with complex APIs such as synthetic peptides, non-oral routes of administration such as the otic, ophthalmic or dermal route, complex formulations such as liposomes, complex dosage forms such as long-acting injectables, or drug-device combinations such as metered-dose inhalers.

For reasons such as the structural complexity of a drug, complicated manufacturing processes, or difficulty in showing BE, the regulator has taken a cautious, albeit consultative, approach.

"For every product, there is a different complexity and different hurdle," says Makarand Avachat, Executive Vice President, Pharma R&D, at Lupin Limited, which exports complex generics such as asthma inhalers to the U.S. "And there are different pathways to cross these hurdles."

Certain high-end analytical equipment is typically found in the Indian Institutes of Technology, Indian Institutes of Science and public-funded research centres.

The USFDA's process of framing product-by-product guidance gained speed only in the last few years. Often, early movers found themselves seeking approval even before the USFDA had firmed up an alternative approval pathway. In 2013, Dr Reddy's in vitro approach to BE for generic Ciprodex was rejected as it was not in keeping with the USFDA's then-prevailing guidelines for such products. It was only in 2015 that the USFDA revisited its guidance and accepted this approach.

Showing equivalence of drugs such as eye and ear drops is just one type of complexity. There are others. Consider liposomal formulations where the drug is enclosed in biocompatible phospholipid bilayers for a safer and targeted delivery of drugs such as ophthalmic and anti-cancer medication. Liposomes are prone to high variability in particle size, which could impact the availability of the drug, its effectiveness and shelf life.

Then, in certain categories such as injectables, the manufacturing process involves multiple steps, entailing tight process controls. In structurally complex APIs, a stringent evaluation may be required, ascertaining that the input material is the same as the innovator's, following the same process of manufacturing as the reference drug and in vitro tests under different conditions to assess its ability to act in the same way.

Knowing exactly what will work to get a particular product approved and then executing it is a lengthy process that demands different skill sets. Compared with ordinary formulations, complex ones such as liposomes "call for additional characterisation with specialised techniques", says Sukhjeet Singh of Sentiss. The generic liposome's particle size, distribution, the content of the drug inside the liposome and the layer of the liposome are some of the features that have to be matched with those of the reference drug.

Characterisation is used to show that the generic has the same physical and chemical characteristics as the reference drug. In the case of generic Ciprodex, too, the characterisation of particle size, shape, viscosity and rheological behaviour, among several other features, played a key role in approval, Gudlavalleti points out.

Developing complex generics calls for a deeper understanding of hyphenated techniques – those that combine different analytical methods and use expensive instruments, says Avachat of Lupin. It is neither possible nor desirable to own all the equipment and skills to operate them, in-house. He cites the instance of peptides, complex APIs made of short chains of amino acids, where the generic is a synthetically made version of a reference product that uses recombinant DNA technology. In such cases, impurity profiling is critical. If the level of an impurity in a generic is higher than in the reference or new impurities are found, these should be demonstrably non-immunogenic. "You cannot possibly set up a lab for immunogenicity testing for a few peptide molecules," he says.

There are other challenges. "(Regulatory) guidance documents do not tell you the methodology," says Ansar Ali Khan, head of technical operations at Mysuru-based contract research organisation (CRO) Vipragen. "You need (to come up with) a way of doing things," Khan, who has worked on complex generics, adds.

Different techniques such as Raman spectroscopy and atomic force microscopy are used in characterisation, Singh says. Scientists have to figure out the right processes. Sometimes, the best techniques, such as the small angle X-ray diffraction, useful for measuring the thickness of liposome bilayers, may not be widely deployed in the Indian drug industry.

Compounding the problem, information about the reference drug is often not entirely accessible. In complex APIs, if manufacturers cannot access the pure API of the reference for comparison, they have to extract it from the formulation without damaging the API structure, Singh says.

In cases where the manufacturing process of the intermediate and final product has to be identical to that of the reference drug, the generic manufacturer looks for "structural signatures" or "tell-tale signs" of the innovator's manufacturing process, Gudlavalleti says. This requires combing through the reference product's patents and other published literature and subjecting it to in-depth analytical tests.

Finally, for some complex generics, a clinical trial may be unavoidable. CROs that can undertake such trials in India are fewer than those that can do routine BE studies. Consider inhalers, says Kiran Marthak, Director, Medical and Regulatory Affairs at Veeda Clinical Research, in Ahmedabad, which has performed such trials.

Subjects must be screened to meet the inclusion and exclusion criteria of the trial. They have to be trained to use inhalers. The inhalation takes place in negative pressure chambers - to ensure that what is inhaled remains in the lungs and to avoid cross-contamination from one subject to another - with doctors observing from outside. "It is not everybody's cup of tea," says Marthak. CROs have to gear up too, he adds.

"For some complex generics, a clinical trial may be unavoidable. CROs that can undertake such trials in India ... have to gear up."

PAVING THE PATH

Over the last decade, Indian companies have upped their game.

For one, they are investing in expert teams. Singh says that while an ordinary generics team has post-graduates in pharmaceutical sciences or analytical chemistry, his company prefers PhDs with published research in areas such as nanoparticles, microemulsions and liposomes for complex generics. Also, unlike generics teams that work on several projects at a time, given the longer and more complex development cycle, such teams cannot be "burdened" with projects, he says.

As more Indian companies venture into different types of complex products, more and more qualified people are emerging in the field. A decade ago, hiring a liposomal formulation expert was virtually impossible in India, says Gudlavalleti. "Now, with at least five different companies dabbling in this, the pool of talent has grown."

Teams are also multi-disciplinary, going beyond pharmaceutical sciences to engineering faculties. For instance, in complex products such as long-acting injectables, a large part of the work is done during the plant scale-up. "It is a massive chemical and mechanical engineering problem and a control-systems one as well," Gudlavalleti says.

HELPING HAND

PHOTO: SHUTTERSTOCK

The U.S. Food and Drug Administration (USFDA) has been investing in analytical methods to compare generic and reference drugs such as therapeutic peptides and complex mixtures. Earlier this year, it approved a complex generic for an ophthalmic suspension using a new in vitro bioequivalence (BE) approach with investments in particle size characterisation and eye models. "Without the new approach, applicants would have had to recruit hundreds of cataract surgery patients to demonstrate BE," said Janet Woodcock, USFDA's acting Commissioner, in June 2021. In 2020, it funded The Center for Research on Complex Generics in the universities of Maryland and Michigan with a $5 million grant to "stimulate innovative dialogue, disseminate current understanding of complex products and practices, and generate new knowledge," the FDA's annual report noted. The centre collaborates with the generics industry through research, training workshops and laboratory projects, among other initiatives.

Companies are also looking at academia and CROs, within and outside the country, for certain capabilities and infrastructure for characterisation and immunogenicity testing. Avachat of Lupin observes that certain high-end analytical equipment is typically found in the Indian Institutes of Technology, Indian Institutes of Science and public-funded research bodies. For others, they look outside the country. For clinical studies, there are CROs such as Veeda, which continue to add capabilities. "There is a lot of scope in in vitro BE (testing) and we are looking into investing in that," says Marthak.

Eventually, with the approval of the first complex generic in a category, much of the regulatory complexity is resolved and more companies invest to meet the development and manufacturing bar. What qualifies as complex today may not be so after some years. At one time, oral controlled-release products were called complex, Avachat recalls. But they are no longer so.

Early movers in a product pave the way for others as they work with the regulator to help shape concrete guidance and improve their odds of being the first. For how long they stay that way boils down to how quickly the rest can follow, or even overtake the front-runner. For some products, this happens more rapidly than others. According to an IQVIA report, in the case of sevelamer carbonate, a drug to lower excess phosphate in the blood in patients with kidney dysfunction, the entry of five generic players led to a drop in generic prices from 72% of the innovator's price to 29% within three quarters of launch.

Dr Reddy's generic of Ciprodex continues to be the only one in the U.S. market other than an 'authorised' one (the innovator's drug sold without a brand name). It is still a difficult product to make, Gudlavalleti says. Whether the competition catches up "is about capability", he sums up.

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH