Automated growth

-

- from Shaastra :: vol 03 issue 11 :: Dec 2024 - Jan 2025

The Indian robotics industry is beginning to stir and shake things up in various sectors.

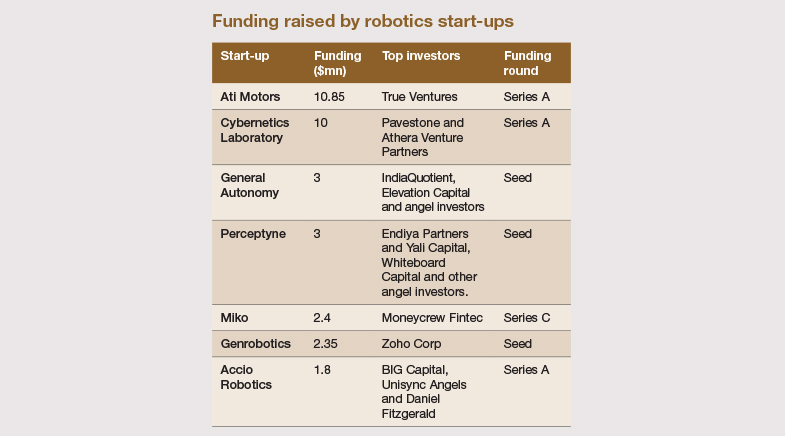

Saurabh Chandra and V. Vinay had built and sold a company each when they teamed with Saad Nasser, a precocious teenager in Bengaluru, to set up Ati Motors in 2017. They had sensed a big demand for robotic vehicles in factories and warehouses, which had to move around things quickly in their premises – heavy stuff that human beings found difficult to handle frequently. Chandra put in the bulk of the initial investments, with Vinay and a few friends of the founders chipping in with additional money. Pre-series funding was done from India in 2021, but Series A funding was led by U.S. investor True Ventures in 2023, as Chandra could not find venture capitalists (VCs) in India willing to put in large sums of money in Ati Motors.

Investor interest has picked up in the sector since then. Soon after the founding of Ati Motors, the National Mission on Interdisciplinary Cyber-Physical Systems (NM-ICPS) provided robotic start-ups with seed money and support through incubators. "This has really excited the VC ecosystem because now they can participate in shaping this later," says Raghu Dharmaraju, CEO of Bengaluru-based ARTPARK at the Indian Institute of Science, which incubates robotics, AI and automation start-ups. ARTPARK was started in 2020 as part of NM-ICPS. "So much capital VCs have raised and now suddenly they can't put that money in software companies," says Chandra. "They have to put it somewhere. All are starting to learn how to put money in more hardware, deep tech and so on." The two other founders moved on from the company to other ventures in 2022.

According to BCC Research, the global robotics market will rise from $67.9 billion in 2023 to $165.2 billion by the end of 2029. The Indian robotics market has been rising and stood at $3.59 billion in 2023, according to Maximize Market Research. It is expected to grow to $8.26 billion in 2030, a growth rate that roughly corresponds to the global growth rate. "It's like how India bypassed credit cards and debit cards to directly jump from cash to UPI or digital payment," says Ganapathy Subramaniam, Founding Managing Partner of Yali Capital. "Like that, factories in India will directly jump from human to full autonomy."

Also growing rapidly is the robotics services market, where robots are being used to provide services. The global robotics services market will grow from $60.16 billion in 2024 to $146.79 billion in 2029, according to Mordor Intelligence. The service industry has been using robotics increasingly in India, too. "The service industry is growing at a very high pace, and because of that service robotics is also growing at a very high pace," says Moinak Banerjee, Co-founder of the Chennai-based Solinas Integrity, which specialises in robotic solutions for pipeline and sewer inspection and cleaning. High cost and complex maintenance kept companies off automation for a long time. So, taking its cues from the success of software as a service (SaaS), the robotics industry is now selling robotics-as-a-service (RaaS). The flexibility, scalability, and cost-effectiveness that comes with renting out robots is now enabling even small and medium-sized enterprises to benefit from cutting-edge automation, democratising access to robotics like SaaS did for software.

Demography and youth choices are also playing a big role in the growth of the robotics sector. The youth population is decreasing across the globe. "The new generation no longer wants to touch three Ds: dull, dirty or dangerous work," says Chandra. Labour shortages, declining cost of robotics components, and AI that supports robotics technology are all fuelling the growth of this sector. However, the use of robotics in the medical sector is lagging in India due to the extended time of regulatory clearances, thereby making it unattractive for investment. Robotics are not being used in India in the agriculture and construction sectors, two big users of robotics in developed markets.

Indian robotics companies find it hard to sell Indian products abroad. "Software you can support remotely, but for robotics you need people on the ground to deploy or implement service," says Chandra, reasoning why it is difficult to go abroad with hardware businesses. Competition is harsh in international markets, and companies have to tweak their products to suit the requirement of international customers, a job that requires huge capital. On the other hand, at the moment, many robotic components have to be imported from abroad, which diminishes the chance of customisation and deep knowledge on such components. "For us to become deep technicians and capture a lot of economic value," says Dharmaraju, "we have to have ownership of these core components."

Robotics companies have slow growth curves and so the country is still waiting for a large success. The most prominent company probably is GreyOrange, founded in 2012 by two students from the Birla Institute of Technology and Science, Pilani. This company started with robotics but has diversified into software and logistics solutions. In 2022, Reliance Retail Ventures picked up a stake in Addverb Technologies for $132 million. It is the largest deal in the sector so far.

See also:

Indian start-ups dive into deep tech phase

Fuel for take-off

Start-ups born on campuses

Bridging the academia-industry gap

Support systems for start-ups

Space start-ups get into a higher orbit

Outlook positive

Chipping in

The rise of quantum.in

India is poised for a tech leap

Have a

story idea?

Tell us.

Do you have a recent research paper or an idea for a science/technology-themed article that you'd like to tell us about?

GET IN TOUCH